Are you a first time family consumer? Finding a lot toward very first time domestic buyer mortgage financing from inside the California? You are in fortune! California also offers of several solutions to have very first time homebuyers to safer property during the a great rate of interest. As one of the leading lenders during the La and you can nearby parts, LBC Financial has the training and you will assistance to obtain the very best price for the unique requires.

While curious about regarding the version of house client financing programs you could potentially take advantage of, keep reading for more info!

The latest California Casing Money Agencies or CalHFA also provides a number of out-of mortgage applications to greatly help first time homebuyers within the California get a property. Such as, the new CalHFA system are a keen FHA (Government Housing Expert)-insured mortgage that gives a 30 year repaired interest home loan in order to the latest property owners.

Addititionally there is new CalPLUS FHA system, that has a slightly large 29-year fixed interest rate as compared to typical CalHFA FHA program. The difference is the fact this type of first time home visitors loan is actually combined with CalHFA No Desire System (called Zip) to support closing costs.

Just like the national-level Va system, California is served by the CalHFA Va system. That is a 30 12 months repaired speed mortgage plus available for first-time property owners. Addititionally there is new CalHFA USDA system which is an initial home loan financing guaranteed of the USDA which is often along with the MyHome Assistance program.

Conventional Loans getting First-time Home buyers within the Ca

California first-time home buyers may also be pleased to learn one CalFHA offers antique mortgage brokers also. Such financing are insured as a result of PMI otherwise Personal Mortgage Insurance rates and you may this new prices is actually repaired into 29 season label. Additionally there is the possibility, as with the us government loan, to pay a high rate of interest and take advantage of the Zero program to suit your settlement costs.

Need assistance having And make a down payment

Discovering minimal deposit should be a primary hurdle for the majority first-time residents in the California. Luckily there are many different options for advice about deciding to make the downpayment and you can closure prices. These funds have been called using loans which means you don’t have to begin making costs in it up to your house is offered, refinanced otherwise paid down, putting some mortgage repayments more affordable.

You will need to keep in mind that which have deferred money, there could be certain conditions of the loan. Including, brand new MyHome program even offers a smaller sized financing towards the americash loans Horn Hill cheaper number out-of 3.5% of residence’s cost otherwise appraised well worth. Other businesses like the USDA and you may Antique financing software render an number up to the latest reduced off step 3%. The overriding point is if they of getting the best bargain on your own very first time house consumer financial within the California, whether you need down-payment or closing rates advice or perhaps not, it is advisable to utilize a ca financial expert one knows the initial need from very first time home buyers and will assist you to maximize your savings while you are enabling you to afford the home you are interested in.

Plus in the latest Ca housing market, land are bought and you may marketed at an unbelievable rate. As the places is actually aggressive, handling a specialist produces a positive change in how much you have to pay – and first time homeowners, it is all concerning the savings.

As to the reasons Like LBC Home loan as your Very first time Homebuyer Financing Pro?

From the regional La LBC Financial place of work, we help possible property owners during the Ca get excellent deals on their mortgage brokers. Very first time homeownership can seem to be particularly a challenging techniques – so many prices and requires and you will qualification steps to adhere to. But not, after you focus on a team which is seriously interested in their achievement, the outcome aren’t anything in short supply of the. We ask that see our a lot of stories from very first time home buyers exactly who chosen us when shopping for an informed financial inside the Ca to assist them get their first household.

And in case you’re in a position for us to, contact us otherwise complete the proper execution right here into all of our webpages. We shall help to help you greatest see the terms and conditions, and help you get the best price for the California first day family client loan – even if you provides an intricate otherwise strange situation.

Faq’s

If you’re an initial-day homebuyer from inside the Ca, you might be curious what type of loan options are readily available for your requirements. Here are a few faq’s which can help you learn the process:

There are many different kinds of earliest-day homebuyer finance available in Ca, in addition to FHA finance, Virtual assistant funds, and you will CalHFA loans. Each type from financing has its own qualification criteria and you may professionals, making it crucial that you do your research before you apply getting a beneficial mortgage.

The quantity you might obtain that have an initial-time homebuyer mortgage are very different depending on the form of financing you select. FHA money, particularly, normally have all the way down loan limits than other type of money. But not, you’re able to obtain more if one makes good big downpayment or meet specific income conditions.

Technically sure. While first-time family visitors financial are blocked of providing refinances, almost every other loan providers could possibly offer your an effective re-finance.

You’ll have a credit history regarding 640 or even more. However, having a higher credit history may result in top loan words.

The mortgage restriction to possess antique, Va, USDA, and you may FHA financing try $647,two hundred as of ount on the CalHFA is the FHFA Higher-Costs Mortgage Limitation from $970,800

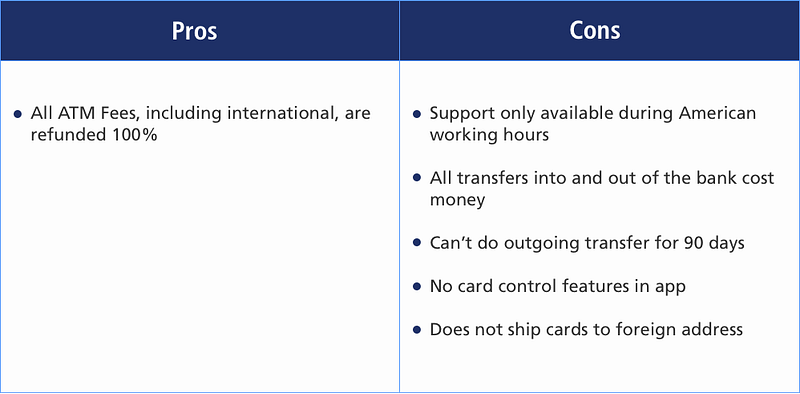

first-time domestic client loans offer several benefits, however, as with any monetary device, there are particular downsides to adopt. One to drawback would be the fact first-time household buyer fund usually have large mortgage insurance fees.

Very first time house customer loans also provide rigorous housing criteria conditions. Residential property have to satisfy FHA safety and health certification, and only no. 1 residences qualify. Also, very first time family buyer mortgage features worth limitations toward family read about our very own low-QM funds for much more flexible financial support alternatives that may top match your needs.